The Benner cycle. Incredibly accurate r/HetFlixmovies

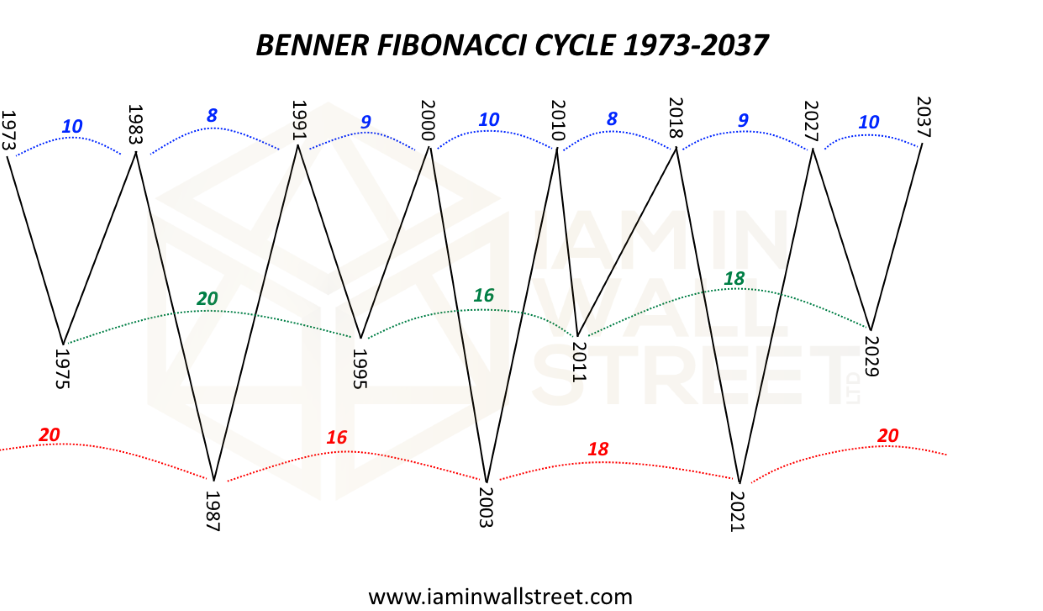

One such theory is the Benner cycle, which is a pattern that has been observed in the stock market over the past 100 years. According to this theory, the stock market moves in a predictable pattern of four phases, each lasting approximately 10 years.

History is cyclical The Benner cycle predicts the ups and downs of the market for 100+ years

What is the Benner Cycle? Is the Benner Cycle accurate? The Great Depression, 1929 to 1941 Oil Crisis, 1973 Black Monday, 1987 Dot Com Bubble, 1995 to 2002 The Financial Crisis, 2007 to 2008 What are the 4 phases of the investment cycle? Which phase begins after the end of the bullish phase? What market cycle are we in now?

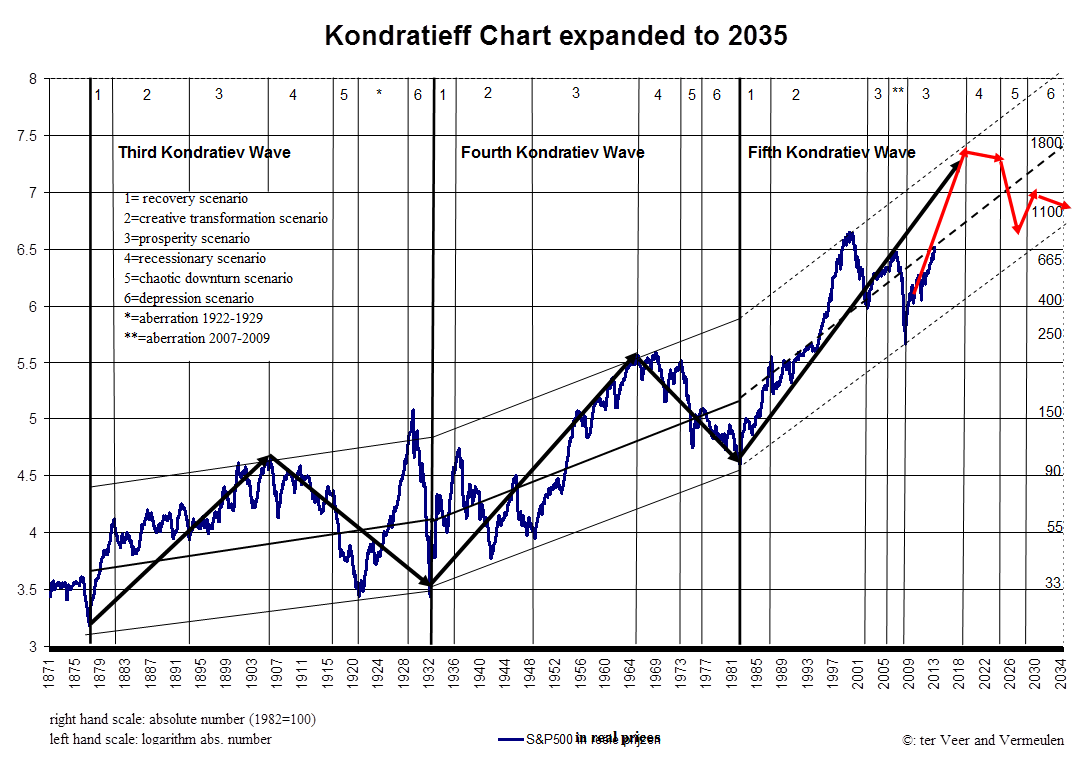

Looking at longterm cycle patterns, what might 2023 hold for equity markets?

The Benner Cycle offers a fascinating insight into how patterns and cycles can provide a unique perspective on market behavior. While not to be taken too seriously, it is a stimulating topic to consider. Stay tuned for more finance-related thoughts and quirks. Remember that investing is more than simply numbers and charts; it is also about.

investing on the waves The Benner cycle

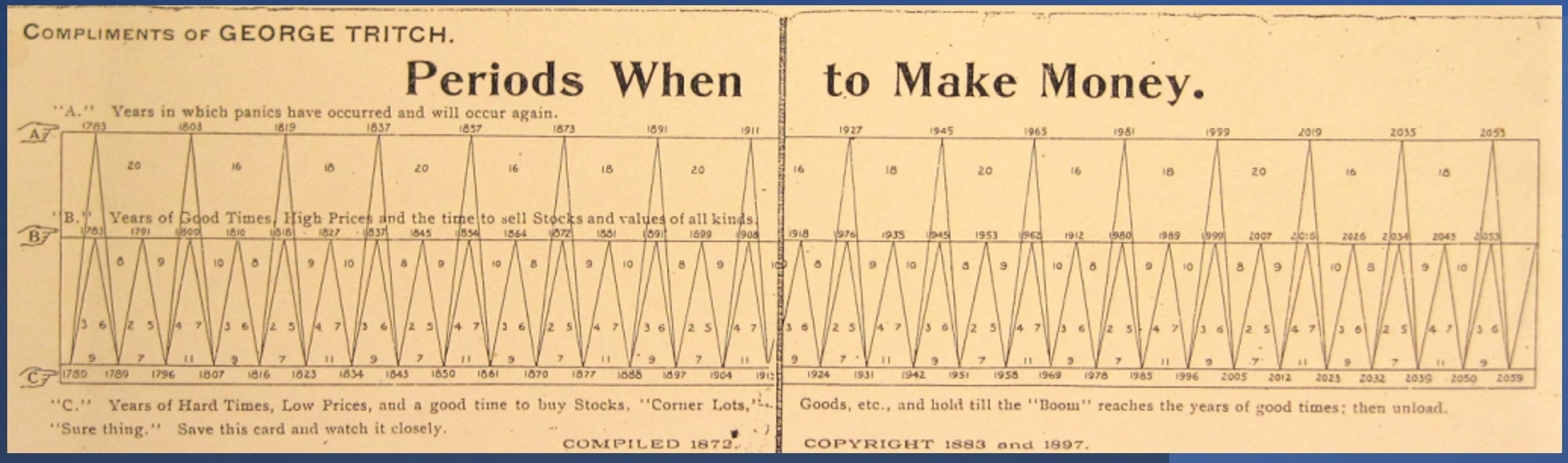

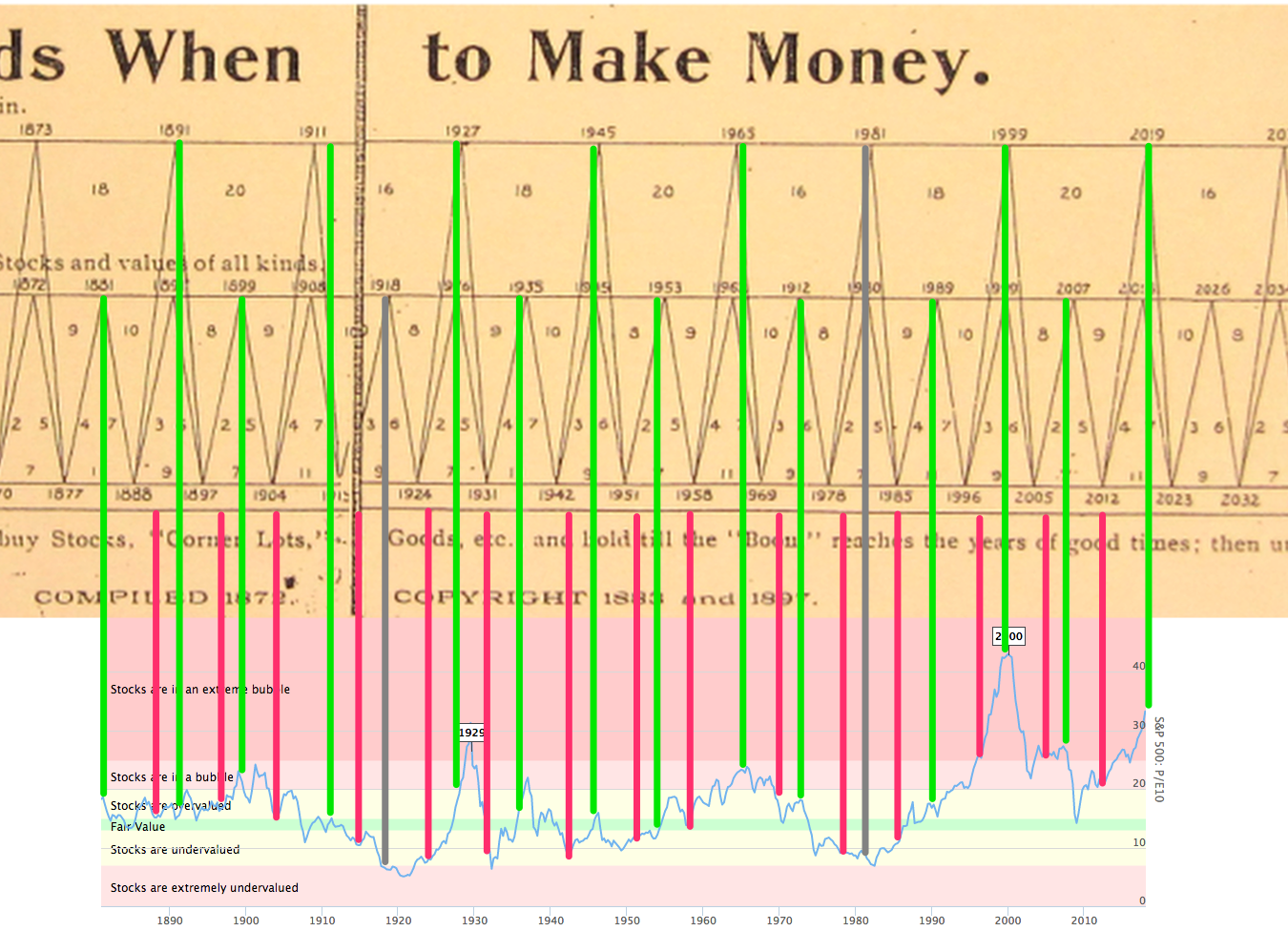

Benner's original cycle had a limited range, only going up until 1891. However, George Tritch, another 19th century forecaster, is believed to have extended the cycle all the way to 2059, and even annotated the chart with specific instructions on when to buy and sell stocks.

Do not the Benner Fibonacci Cycle I Am In Wall Street

Exploring the origins of the " Periods When to Make Money " Chart, also known as the Benner Cycle, historical records present a complex narrative. The first diagram traced back to the late 1800s, cites dual origins: George Tritch in 1872 and Samuel Benner in 1875.

Benner Cycle Making Accurate Market Prophecy For 100+ Years, Is It Really The Tool Investors Need?

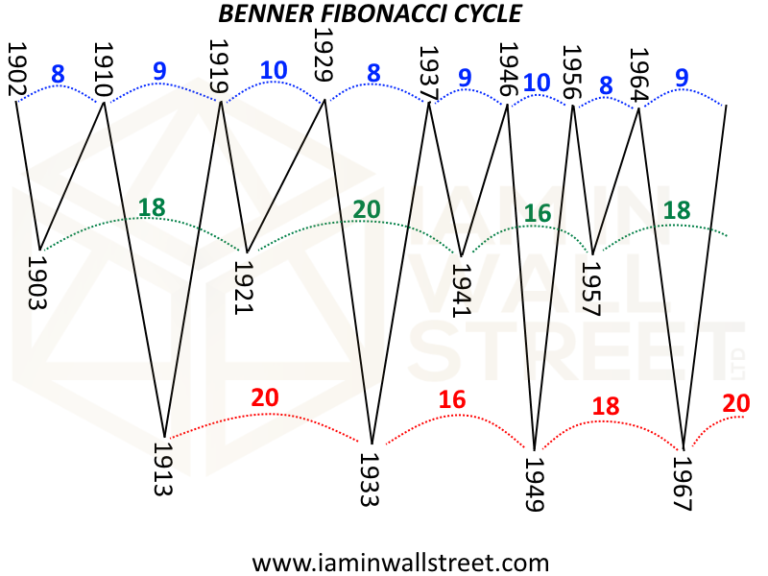

The Benner Cycle is a model that Benner developed to predict the ups and downs of the stock market. It consists of three lines: A, B, and C. The A line represents years of market panics, which.

Los ciclos de Benner bolsacanaria.info

The 54 year cycle arises from panics every 16, 18, 20 years (upper line Diagram 1). According to Benner (1875), "it takes panics 54 years in their order to make a revolution or to return to the same

Tradersaffiliates,stock timing,stock market cycles

The Benner cycle also uses a 27-year cycle in pig iron prices with low prices every 11, 9, 7 years and peaks coming in at 8, 9, 10 years. Studying market history will help you learn how these cycles affect the price and how they still affect the price today. Now the year is 2024, and according to the Benner cycle, we are just coming out of a.

(PDF) Benner Cycles & the 9/56 year grid

5,000,000 members are already taking advantage of our discounts. Become a member for Free! We believe the best kit should be available to everyone - no matter what level.

The Benner Cycle Short Version Market Mondays w/ Ian Dunlap YouTube

What is the Benner cycle? Posted on April 19, 2023 Technical analysis and economic history are full of authors and theories. Some authors have fallen into oblivion but their theories have endured. One of them is Samuel Benner.

Benner's Stages by Ashlie Whitt YouTube

In this fascinating and insightful video, we explore the mysterious Benner Cycle, a century-old forecasting model that has accurately predicted market patter.

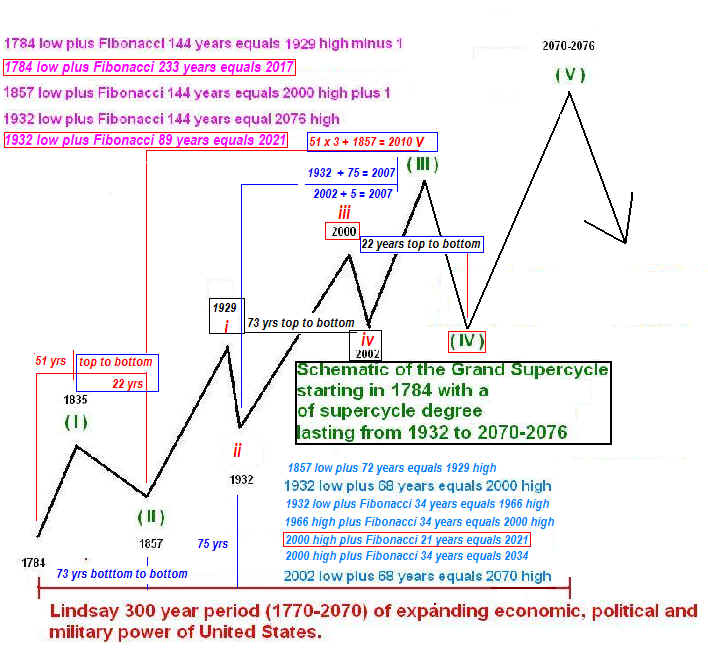

The Elliott Wave Surfer The BennerFibonacci Cycle

What Is Benner Cycle? In 1875, Samuel Benner, an Ohio farmer, published a book called "Benners Prophecies: Future Ups And Down In Prices". The book had charts of prices of pig iron, corn, hogs, and cotton. As Benner said it was to inform others on how to make "money on pig iron, corn, hogs, and cotton."

ECLIPTIC POSITION FOR THE BENNER & 9/56 YEAR CYCLES Ecliptic position... Download Scientific

The Benner cycle also uses a 27-year cycle in pig iron prices with lows every 11,9,7 years and peaks coming in at 8, 9, 10 years. Studying market history helps you learn how these cycles affect price, and how they still affect price today. Now, the year is 2021, and on the Benner Cycle, we are just coming out of a panic cycle.

Prophets of Wall Street (Cycles part 2) Silvan Frank

The Benner Cycle: Sure Thing or an Illusion? Posted by Price Action Lab Blog on October 30, 2023 Photo by Alesia Kozik We tested the performance of the Benner Cycle and also examined its philosophical underpinnings. Is the cycle the "sure thing", as its inventor claimed, or an illusion?

A schematic representation of Benner theory. Download Scientific Diagram

The Benner Cycle was purportedly created in 1875 to identify potential "boom" and "bust" periods in the economy. Stock market results within various favorable and unfavorable periods appear compelling. In Part I, we examine the performance of the S&P 500 Index during the major favorable and unfavorable periods in the past 100 years.

Do not the Benner Fibonacci Cycle I Am In Wall Street

On Benner's cycle chart, four main events create a full market cycle: After the bottom of the mid-cycle, a new market cycle starts (1). The chart shows the years of euphoria, the hard years, and the years of panic. Starting in 1924, a new cycle begins every 18/16/20 years. Starting in 1927, a new market cycle top occurs every 18/20/16 years.